Quick Take: SEC’s Landmark Climate Disclosure Ruling

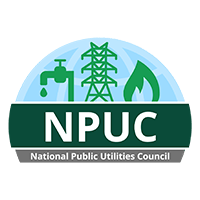

In a highly-anticipated decision, the Securities and Exchange Commission (SEC) ruled today to enact mandatory climate disclosure requirements for public companies in the U.S. As anticipated, the ruling includes much of the Scope 1 and Scope 2 reporting requirements outlined in the March 2022 proposal. Public companies will be required to disclose their direct emissions, as well as key business risks posed by climate change. However, the ruling eliminates the Scope 3 emissions requirements outlined in the earlier proposal, which would have required companies to disclosure indirect emissions produced along the value chain. This decision marks a milestone moment in the climate movement and U.S. history.

Scope 1 and 2: A Step Forward, But Is It Enough?

For the first time, U.S. companies will be required to disclose climate risks publicly. By requiring companies to report on Scope 1 and Scope 2 emissions, the SEC is mandating transparency on direct emissions from owned or controlled sources and emissions from the generation of purchased electricity, steam, heating, and cooling. This is undeniably a step in the right direction, providing a clearer picture of a company’s direct impact on climate change.

Scrapping Scope 3 Requirements

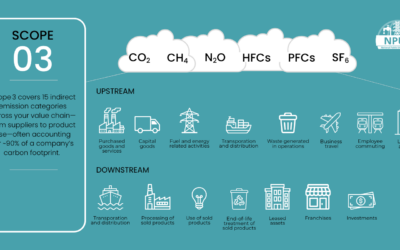

However, the elimination of Scope 3 reporting requirements—emissions from activities that the organization indirectly generates along its value chain—has sparked controversy. For climate activists and those advocating for full emissions transparency, this decision represents a setback. Scope 3 emissions often represent the largest share of an organization’s carbon footprint, where indirect emissions play a significant role in the company’s overall impact on the environment.

Implications for Companies

Without the requirement to report Scope 3 emissions comprehensively, companies will be allowed greater flexibility in their reporting strategies. This could potentially lead to reporting maneuvers that emphasize progress on emissions reductions without requisite action. The ruling might allow companies to project an image of environmental responsibility, while substantive reductions in emissions remain unaddressed.

What’s Next: Mandated Disclosures and Legal Battles Ahead

The SEC’s decision is a clear signal that the era of voluntary environmental reporting is coming to an end. Companies will need to adapt to climate requirements, integrating them into their financial and sustainability reporting mechanisms.

However, this is likely just the beginning of a more extensive legal and regulatory battle over climate disclosures. Given the contentious nature of the SEC’s ruling, especially the exclusion of comprehensive Scope 3 reporting, legal challenges from both sides of the debate are anticipated. Environmental groups may push for more stringent reporting requirements, while some industry players may challenge the new regulations as overreach.

Conclusion

As we stand at the cusp of a new era in corporate environmental accountability, the SEC’s ruling on climate disclosures represents a critical, albeit imperfect, step forward. While the decision reflects a compromise between environmental transparency and regulatory overreach, it also highlights the ongoing tension between economic interests and the urgent need for climate action. As the implications of this ruling unfold, companies, investors, and activists alike will need to navigate this evolving landscape with a keen eye on both the opportunities and challenges it presents.

Learn more about how electric utilities and the power sector can lead on the path toward decarbonization here.