The $3 Trillion Clean Energy Investment Gap, Visualized

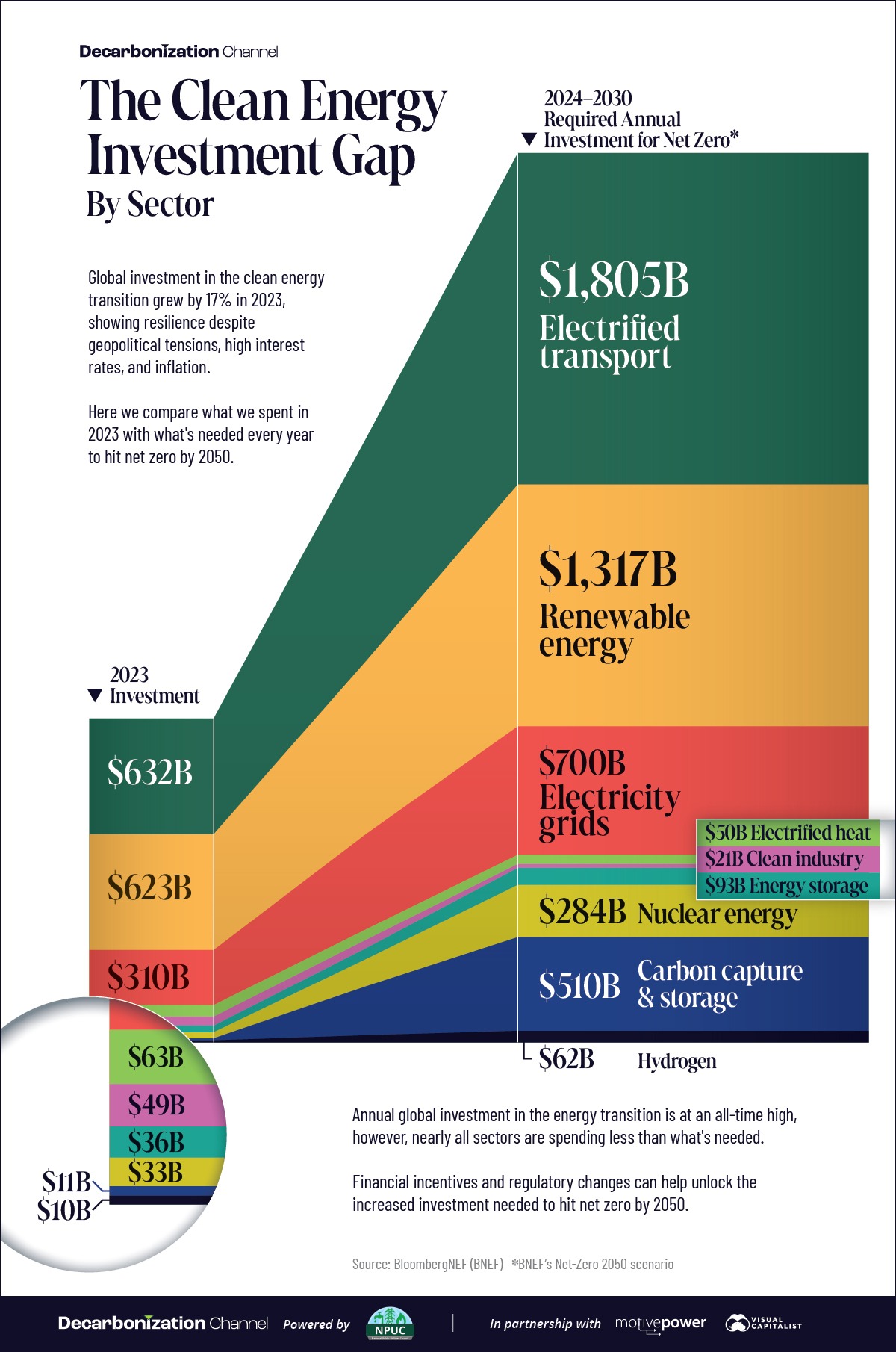

Global investment in the clean energy transition grew by 17% in 2023, showing resilience despite geopolitical tensions, high interest rates, and inflation.

But was it enough to keep the world on track to hit net zero by 2050?

To answer this question, we compare 2023 clean energy investment by sector with what’s annually needed to reach net zero by 2050, in partnership with the National Public Utilities Council.

The Investment Gap, By Sector

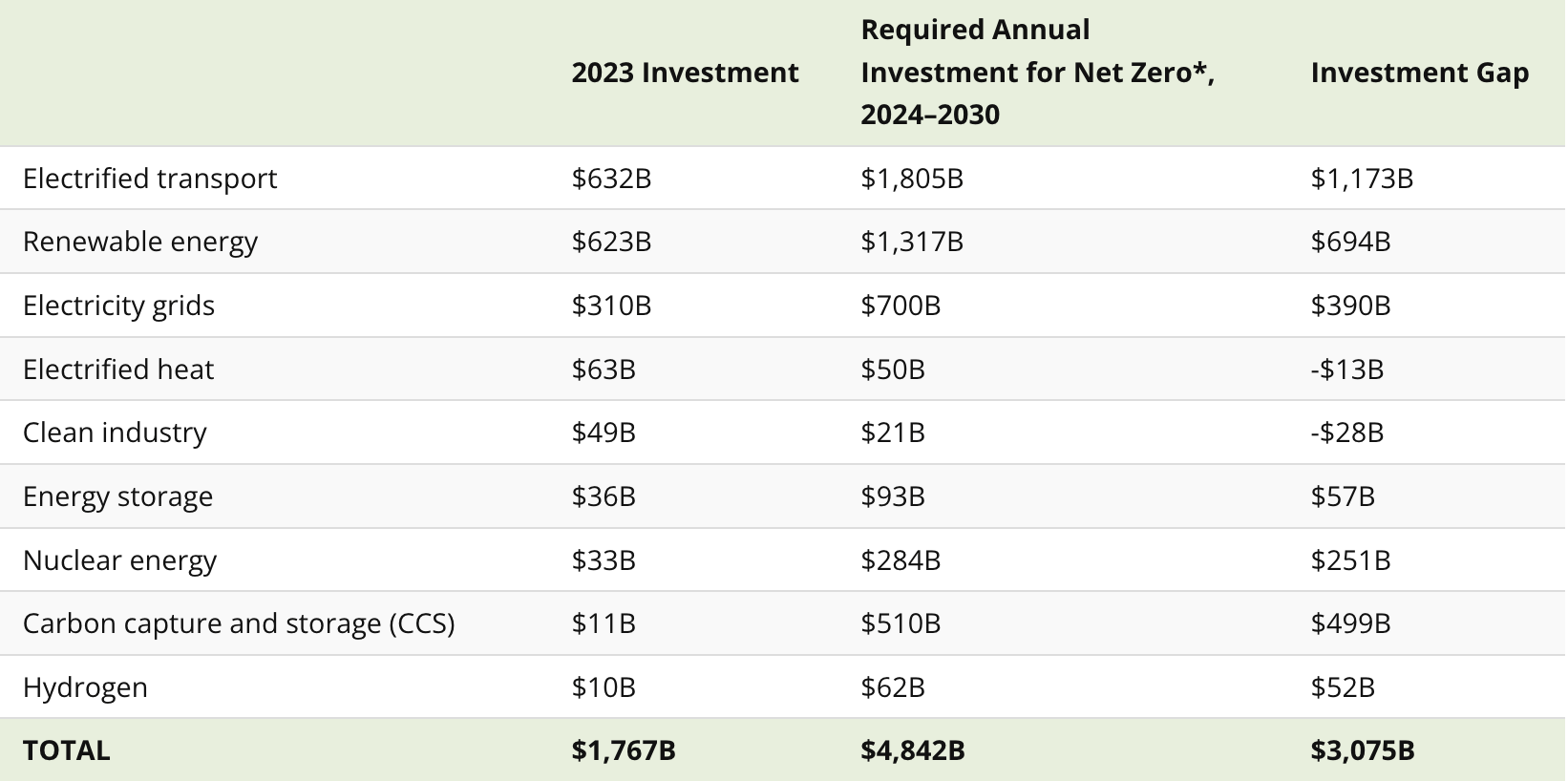

According to BloombergNEF data, annual global investment in the energy transition is at an all-time high. Despite this, only the electrified heat and clean industry sectors are meeting the thresholds necessary to hit net zero by 2050.

*BloombergNEF’s Net-Zero 2050 Scenario

To stay on track for net zero by 2050, the yearly investments in electrified transport, renewable energy, power grids, and energy storage must more than double their current rates for the rest of the decade.

Hydrogen, nuclear, and carbon capture and storage (CCS) have an even steeper hill to climb and must grow 6, 9, and 46 fold, respectively.

The Path Forward

It’s important to note that despite the current annual investment gap of $3T, the clean energy industry continues to exhibit positive trends.

Investment in electrified transport, for instance, surpassed that in renewable energy for the first time in 2023, marking a win for the sector.

Emerging sectors also experienced robust expansion despite being furthest off-target. Investments in hydrogen tripled to $10B, CCS nearly doubled to $11B, and energy storage witnessed a 76% increase to reach $36B in 2023.

These encouraging developments underscore the industry’s potential to drive transformative change and pave the way for a more sustainable and resilient energy landscape in the years ahead.

According to research by ONYX Insight, almost 60% of wind farm operators reported that supply chain issues were their biggest challenge over the next 2–3 years.

International collaboration and investment, however, can help diversify manufacturing outside of China. In addition, policymakers can also implement policies and incentives that encourage the growth of local manufacturing capacity for renewables.

All in all, streamlining processes, investing in infrastructure, and promoting local manufacturing can pave the way for a cleaner, more sustainable energy future.

Learn more about how electric utilities and the power sector can lead on the path toward decarbonization here.